Penfold Pensions - AutoSave Pilotfor the Self-Employed

Role: Senior UX/UI Designer | Stakeholders: Lead Product Manager, Nest Insight / DWP

Method: Agile, Lean UX | Principles: User-centered Design, Service Design | Tools: Figma

Visit Penfold Pensions

Overview

The auto-save pilot scheme, supported by the government, and in partnership with Nest Insight. Will use OpenBanking technology to work out affordable contributions and help self-employed people save for retirement.

Users will be able to connect their bank account to Penfold and select a percentage of their excess income to save. Penfold will then scrutinise the saver’s monthly income and expenses and nudge those with excess monthly income to save more into their pensionThe pilot, which is supported by the Department for Work and Pensions (DWP), will test different forms of flexible savings solutions and nudges. For instance, it will urge the self-employed workers to save at certain times, such as when they receive a large payment.

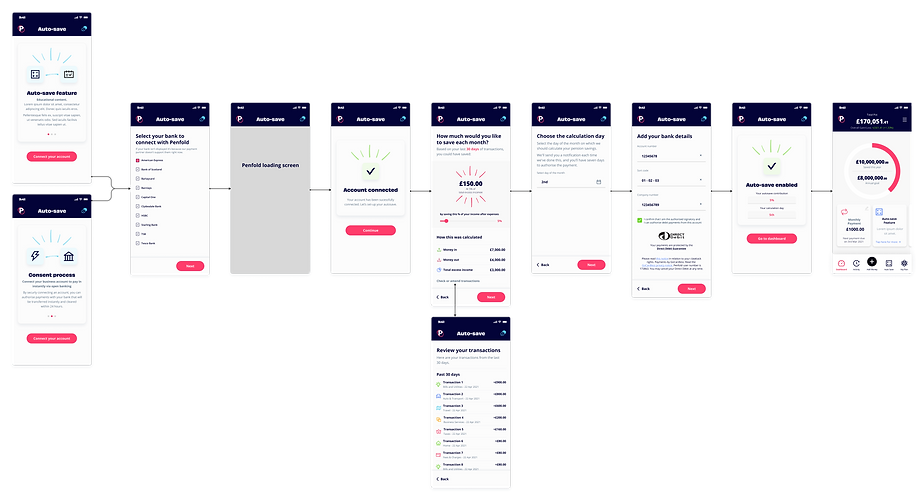

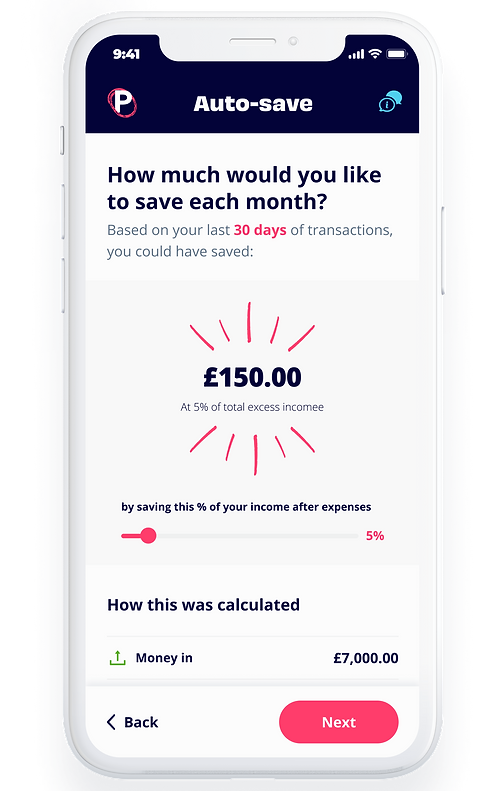

Feature Onboarding

The onboarding journey for a first-time user of this pilot feature can begin from various points depending on which test group the user has been allocated to. These include a dashboard tile from the Home Screen, a button it the burger menu, a push notification or a link from an email campaign.

The journey consisted of educational content and breakdown of the consent process, OpenBanking authorisation steps, and initial configuration of selecting a percentage of income they would like to save and which day of the month the calculation should run.

User Testing Group Example

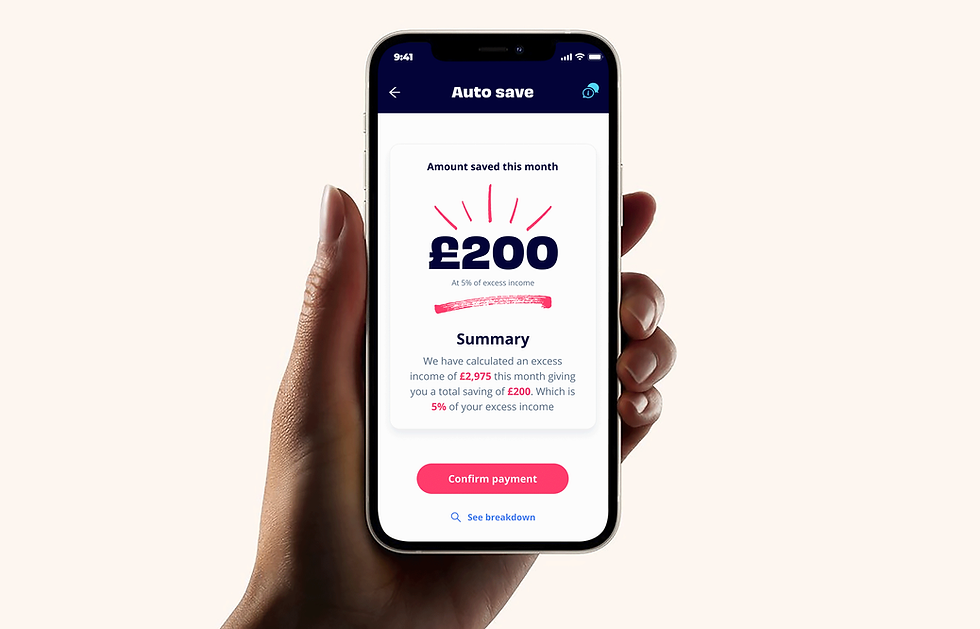

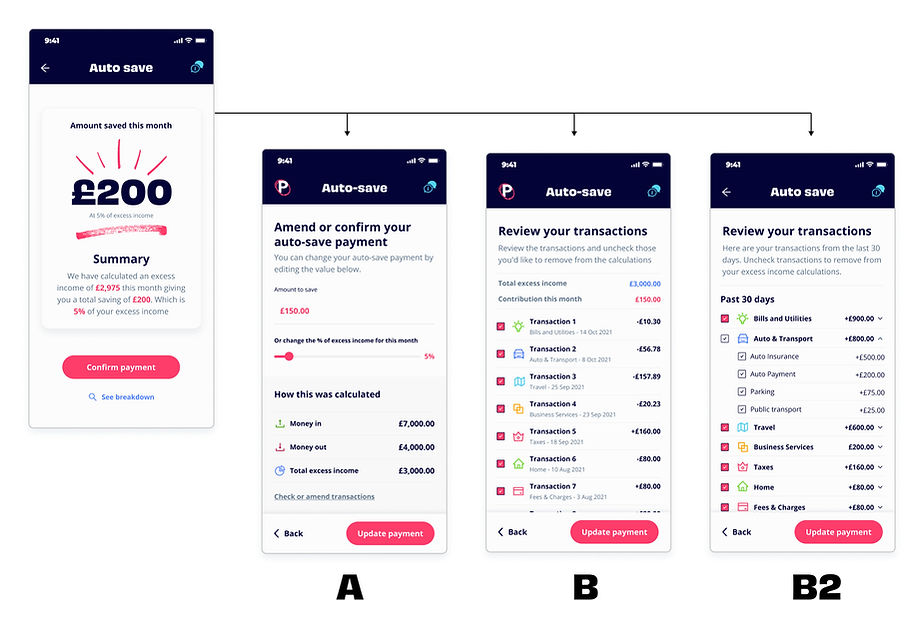

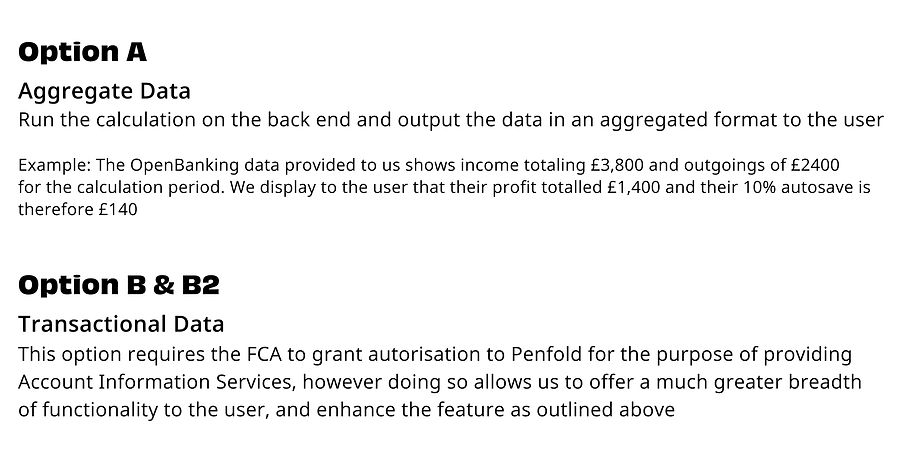

A problem point that we came across from the data set provided from Nest Insight, was that users were not 100% confident in the calculation method that is used to calculate automatic affordable savings each month. As it relies on quality transactional OpenBanking API data to run calculations accurately.

To assure the user we decided we needed to display the transactional data in the calculation output. And even enhance the feature by giving the user the ability to, at that stage, remove certain transactions from the calculations (I.e user may want to remove an extraordinary one-off payment or expense) However these enhancements would not only increase development complexity but also have compliance implications.

We tested the screen variations on a small focus group made up of Penfolds user community, we asked “Is there anything you would like to add to this feature” and the top two answers were to be able to manually remove transactions, and view the transactions in the calculations each month. These results confirmed our assumptions regarding transaction data and validated Penfolds' decision to apply for FCA authorisation to provide Account Information Services.

Auto-Save Settings

The application for FCA authorisation allowed us to offer much more advanced configurations around the AutoSave feature to the user, ultimately giving a grater sense of control. These included an option to set a minimum monthly payment in case the auto-payment would result in a low value or miss a payment altogether, an option to set a payment cap in case the calculation would result in very large payments, an option to remove certain classifications from the profit calculation (i.e. internal transfers) etc.

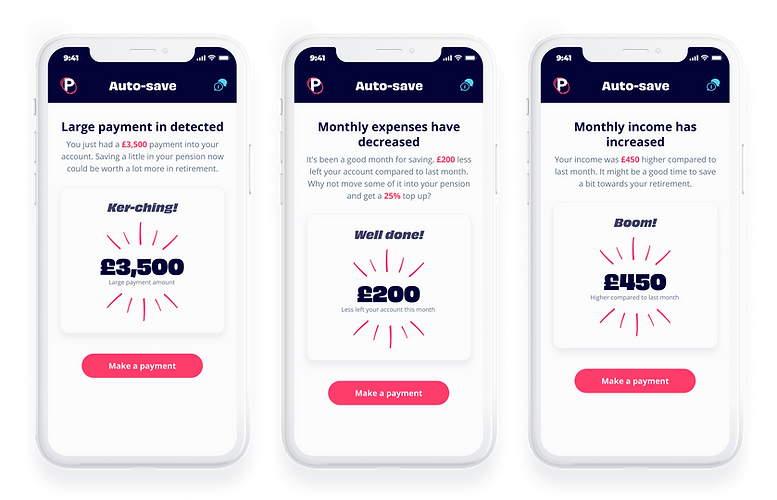

Payment Nudge Examples

The payment nudging solution is based on OpenBanking transactional data and is designed to encourage user to make a pension contribution. These can trigger when a significant income transaction has been detected or the users income has increased compared to previous months. These nudges then direct the user to Penfolds payment flows to complete a top-up.